Most personal injury lawyers have had more than a few encounters with consumer bankruptcy proceedings. Personal injury clients frequently file personal bankruptcies.

It is therefore important to know how personal injury claims, settlements, or awards are treated in bankruptcy. The question everyone wants to know is will the client get to keep some or all of their settlement or judgment?

The short answer is yes – as long the settlement proceeds are compensation for pain and suffering or future lost wages.

What Is Maryland’s “Personal Injury Claim” Exemption?

When someone files bankruptcy they are required to disclose all of their property and assets. A debtor’s property and assets definitely include any potential legal claims they may have against 3rd parties. The debtor’s assets and property will become part of the bankruptcy estate unless they are specifically covered by an exemption. Bankruptcy debtors get to choose between federal exemptions or state exemptions. In some states, there is a strategic choice between the two, but in Maryland, the state exemptions are always better for debtors.

In the vast majority of Chapter 7 bankruptcies, all of the debtor’s property & assets are fully covered by the applicable exemptions. The result is what is referred to as a “no asset” case. All unsecured debts get discharged (except for student loans, taxes, and child support) and creditors receive nothing. When the available exemptions do not fully protect the value of the debtor’s assets, the bankruptcy trustee is supposed to liquidate the non-exempt property and distribute the proceeds to creditors.

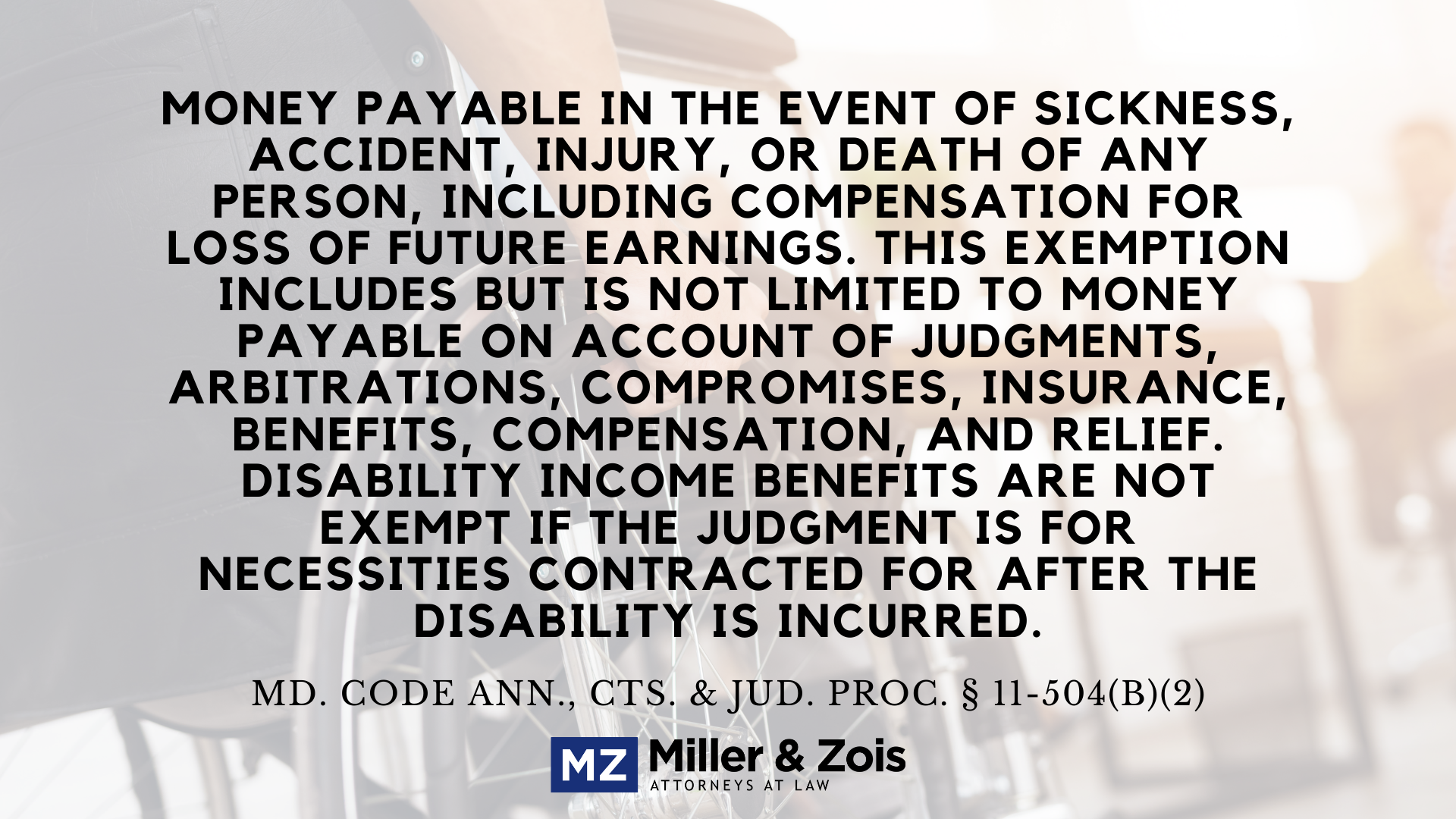

In Maryland, the proceeds from any personal injury claims can be protected by the “personal injury” exemption which is set forth at Md. Code Ann., Cts. & Jud. Proc. § 11-504(b)(2). This section provides an exemption for:

In Maryland, the proceeds from any personal injury claims can be protected by the “personal injury” exemption which is set forth at Md. Code Ann., Cts. & Jud. Proc. § 11-504(b)(2). This section provides an exemption for:

money payable in the event of sickness, accident, injury, or death of any person, including compensation for loss of future earnings. This exemption includes but is not limited to money payable on account of judgments, arbitrations, compromises, insurance, benefits, compensation, and relief.

There is no cap or limit on the amount of this exemption so personal injury proceeds are fully exempt whether the amount is for $5,000 or $5,000,000. At first glance, Maryland’s “personal injury” exemption may seem like a blanket exemption that fully protects all personal injury settlements or judgments. Unfortunately, the exemption is not quite as broad as it may seem.

The personal injury exemption under § 11-504(b)(2) only covers a monetary award to the extent that it compensates for pain & suffering and future lost wages. Any part of the award that is compensation for prior lost wages or past medical expenses is not covered under the exemption.

This limitation on Maryland’s personal injury exemption has been carved out by a series of cases decided by the Maryland Court of Appeals and the U.S. Bankruptcy Court for the District of Maryland. The Bankruptcy Court explained the reasoning for this limitation as follows:

[the] purpose of § 11-504(b)(2) is to make whole, in the eyes of the law, a person who has been injured. Section 11-504(b)(2) forbids attachment of money that was awarded to a person for sickness, accident, injury or death, thereby protecting the debtor from being required to pay creditors with a pound of flesh.

In re Hurst, 239 B.R. 89, 91 (Bankr. D. Md. 1999). Under this “pound of flesh” reasoning, the courts have held that only money paid for “injuries to the person” (i.e., pain & suffering or future economic damages) is exempt under § 11-504(b)(2). Payments for lost wages and past medical expenses are considered compensation for property loss and therefore not covered by the “injury to the person” exemption. The fact that these “property losses” are the direct result of a personal injury does not make them exempt under § 11-504(b)(2). See In re Hernandez, 272 B.R. 178, 180 (Bankr. D. Md. 2001).

Past vs. Future Economic Damages

Economic damages from a personal injury case (i.e., lost wages & medical expenses) are not protected under Maryland’s personal injury claim exemption. However, this does not mean that all economic damages become part of the bankruptcy estate.

In a Chapter 7 bankruptcy, only pre-petition property & assets are included in the bankruptcy estate. Any wages a debtor earns or property they acquire after they file their bankruptcy are not part of the estate. This means that a bankruptcy trustee can only go after economic damages for lost wages and medical expenses that were incurred BEFORE the bankruptcy was filed. Any compensation they get for future medical expenses or future lost income will not be part of the bankruptcy.

Drafting Settlements for Clients in Bankruptcy

The language of a settlement agreement will determine how the money gets treated in bankruptcy. If the settlement agreement specifically states that a certain amount of the total award is for prior lost wages or prior medical expenses, then those portions of the settlement will be fair game for the bankruptcy trustee.

However, if the settlement agreement does not specifically state that a portion of the proceeds is for past wages and expenses then it will be very difficult for the bankruptcy trustee to go after any settlement at all. So a carefully drafted settlement agreement can usually protect the client’s settlement award from bankruptcy.

Future Lost Wages are Included in Chapter 13

In Chapter 7 bankruptcy, only pre-petition property and assets are part of the estate so compensation for future economic losses (wages, medical expenses, etc.) are safe. If a P.I. client is filing a Chapter 13 bankruptcy, however, the issue becomes more complicated. In Chapter 13 the debtor’s future wages must be factored into their plan once the money is received.

Maryland Injury Law Center

Maryland Injury Law Center